Declining balance method formula

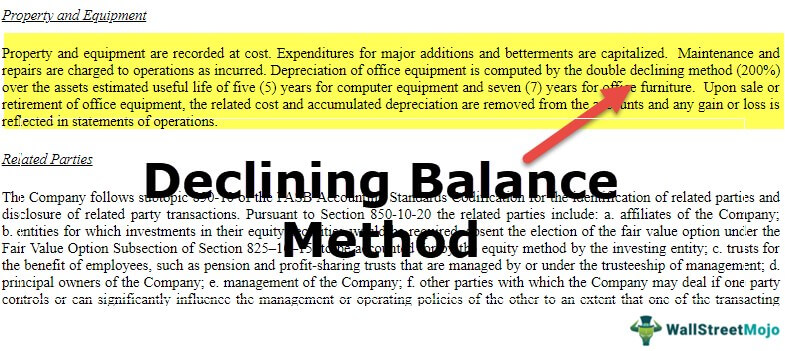

The diminishing balance depreciation method is one of the three depreciation methods mentioned in IAS 16. The double-declining balance DDB depreciation method is an accelerated method that multiplies an assets value by a.

Depreciation Formula Examples With Excel Template

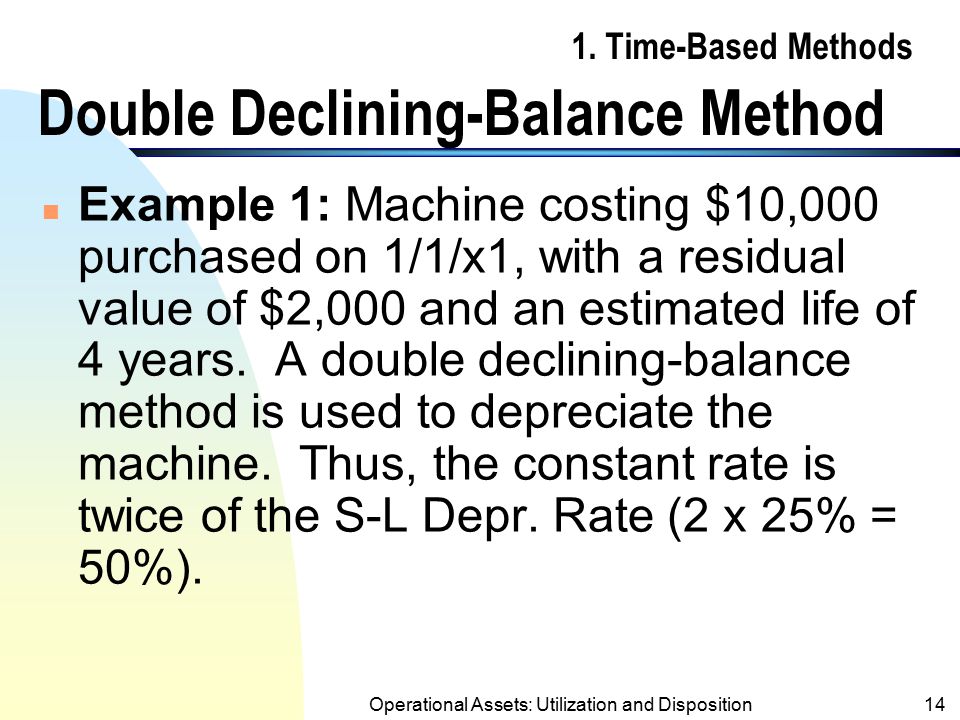

The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset.

. Useful life 5. Double-Declining Balance DDB Depreciation Method Definition With Formula. This is because the charging rate is applying to the Net Book Value of Assets and the Net Book.

X wants to charge depreciation using the diminishing balance method and wants to know the amount of depreciation it should charge in its profit and loss account Profit And Loss Account The Profit Loss account also known as the Income statement is a financial statement that summarizes an. Its value indicates how much of an assets worth has been utilized. French declining balance is an accelerated method of depreciation and may need to be plugged for the total amount of depreciation expense to equal the depreciable cost.

Depreciation amount Asset value x Annual percentage. Calculate the rate of depreciation is 15Mr. Calculate the depreciation expenses for 2012 2013 2014 using a declining balance method.

This is a guide to Double Declining Balance Method. The more pages you order the less you pay. Declining Balance Method.

Hearing loss is a partial or total inability to hear. Under the straight line method depreciation is provided evenly over the lifetime of an asset at a. This method is more suitable in case of leases and where the useful life and the residual value of the asset can be calculated accurately.

Depreciation 5 million 1 million 10. The key difference between these two methods is their computation of depreciation expense. The accelerated depreciation rate to be used in the declining balance method will be found by multiplying the straight-line depreciation percentage by 15 150 percent.

The formula for declining-balance depreciation is created in cell E8. Consider a piece of property plant and equipment PPE that costs 25000 with an estimated useful life of 8 years and a 2500 salvage value. We can also offer you a custom pricing if you feel that our pricing doesnt really feel meet your needs.

It is common for a company to switch from the declining balance depreciation method to the straight-line method in the year that the depreciation from the straight-line depreciation method is greater. The depreciation rate that is determined under such an approach is known as declining. Use this calculator to calculate an accelerated depreciation of an asset for a specified period.

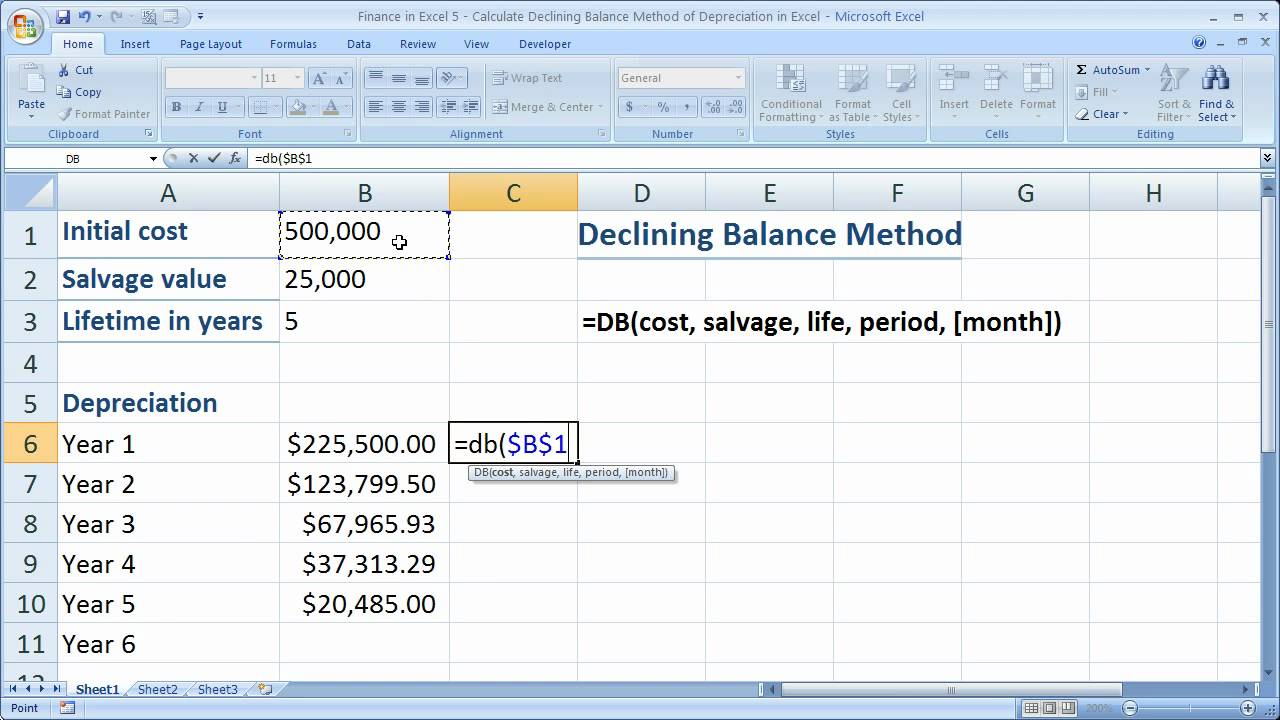

This is how you can take advantage of the Percentage declining balance depreciation method calculator. Periodic Depreciation Expense Beginning book value x Rate of depreciation. What is the Double Declining Balance Depreciation Method.

Sign up for our daily and breaking newsletters for the top SA. In children hearing problems can affect the ability to acquire spoken language and in adults it can create difficulties with social interaction and at work. Diminishing Balance Depreciation Method.

To calculate the double-declining balance. Declining Balance Method Formula. As stated in Section 1 you can manually adjust the depreciation expense or you can include.

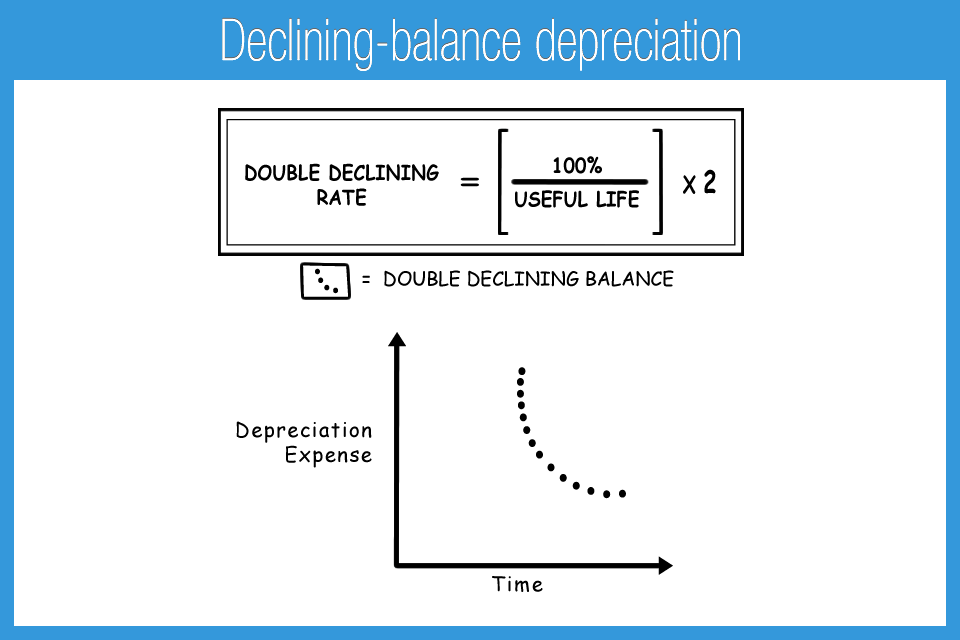

A usual practice is to apply a 200 or 150 of the straight line rate to calculate and apply depreciation expense for the period. A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the Double Declining Balance MethodUse this calculator for example for depreciation rates entered as 15 for 150 175 for 175 2 for 200 3 for 300 etc. Depreciation 2 Straight line depreciation percent book value at the beginning of the accounting period.

The warehouse would depreciate by 110 or 10 percent each year. Under the Declining Balance Method Formula the depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Hearing loss can be temporary or permanent.

However where the repairs are low in the initial years and increase in subsequent years this method will increase the charge on profit. Double Declining Balance Depreciation Method. Complex calculations are made simple with this calculator.

Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular depreciation approach. It is frequently used to depreciate fixed assets more heavily in the early years which allows the company to defer income taxes to later years.

2 x Straight-line depreciation rate x Remaining book value A few notes. D j VDBC Sn n j-1 j factor FALSE. We guarantee a perfect price-quality balance to all students.

How does the reducing balance method differ from the straight-line method. Fine-crafting custom academic essays for each individuals success - on time. The VDB function has this feature built-in.

Hearing loss may occur in one or both ears. Straight line depreciation percent 15 02 or 20 per. Use a depreciation factor of two when doing.

In the above table it can be seen. Asset cost - accumulated depreciation book value. For the double-declining balance method the following formula is used to calculate each years depreciation amount.

Depreciation per year Asset Cost - Salvage Value. By using this formula. Here we discuss the definition formula and example along with the advantages and disadvantages of the Double Declining Balance Method.

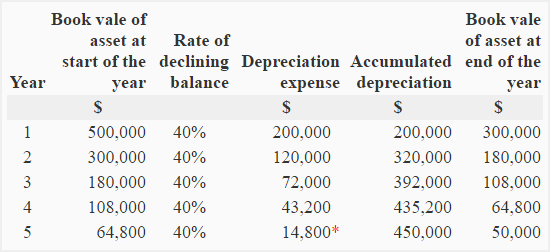

The following is the formula. Our formula would look like this. The declining balance method is a widely used form of accelerated depreciation in which some percentage of straight line depreciation rate is used.

A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance. From healthy diet plans to helpful weight loss tools here youll find WebMDs latest diet news and information. Hearing loss may be present at birth or acquired at any time afterwards.

Hence it is known as the Straight line method SLM. In the double declining balance Double Declining Balance In declining balance method of depreciation or reducing balance method assets are depreciated at a higher rate in the initial years than in the subsequent years. Depreciation expenses for the nearest whole month.

News about the San Antonio Spurs. This kind of depreciation method is said to be highly charged in the first period and then subsequently reduce. Depreciation formula for the double-declining balance method.

You may also look at the following articles to learn more Depreciation Expenses Formula. A constant depreciation rate is applied to an assets book value each year heading towards accelerated depreciation. The basic formula for calculating the declining percentage or declining balance depreciation is as follows.

The formula for calculating the depreciation for year j is.

Declining Balance Depreciation Double Entry Bookkeeping

Declining Balance Method Of Depreciation Formula Depreciation Guru

Declining Balance Method Definition India Dictionary

Finance In Excel 5 Calculate Declining Balance Method Of Depreciation In Excel Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

What Is The Double Declining Balance Ddb Method Of Depreciation

Double Declining Balance Depreciation Daily Business

Double Declining Balance Method Prepnuggets

Simple Tutorial Double Declining Balance Method Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

Declining Balance Method Of Depreciation Definition Explanation Formula Example Accounting For Management

Declining Balance Depreciation Calculator

Double Declining Balance Depreciation Method Youtube

Profitable Method Declining Balance Depreciation

Declining Balance Method Of Depreciation Examples

Depreciation Formula Calculate Depreciation Expense

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube